| Jul -Sep 24 | Oct 24 onwards | ||||

|---|---|---|---|---|---|

| Residential Tariff | Old Tariff (Rs/Unit) | New Tariff (Rs/Unit) | New Tariff (Rs/Unit) | Fixed Charges (PKR/Con/M) | |

| PROTECTED | |||||

| 0 to 50 Units (Lifeline) | 3.95 | 3.95 | 3.95 | – | |

| 51 – 100 Units (Lifeline) | 7.74 | 7.74 | 7.74 | – | |

| 001 – 100 Units | 7.74 | 7.74 | 11.69 | – | |

| 101 – 200 Units | 10.06 | 10.06 | 14.16 | – | |

| UNPROTECTED | |||||

| 001-100 Units | 16.48 | 16.48 | 23.59 | – | |

| 101-200 Units | 22.95 | 22.95 | 30.07 | – | |

| 201-300 Units | 27.14 | 34.26 | 34.26 | – | |

| 301-400 Units | 32.03 | 39.15 | 39.15 | 200 | |

| 401-500 Units | 35.24 | 41.36 | 41.36 | 400 | |

| 501-600 Units | 36.66 | 42.78 | 42.78 | 600 | |

| 601-700 Units | 37.8 | 43.92 | 43.92 | 800 | |

| Above 700 Units | 42.72 | 48.84 | 48.84 | 1000 | |

| TOU (PEAK) | 41.89 | 48 | 48 | 1000 | |

| TOU (OFF – PEAK) | 35.57 | 41.68 | 41.68 | ||

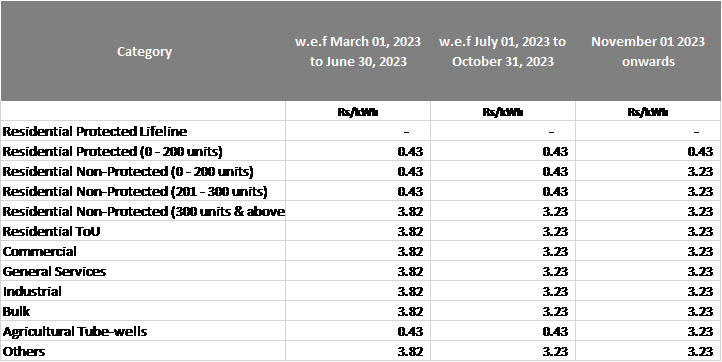

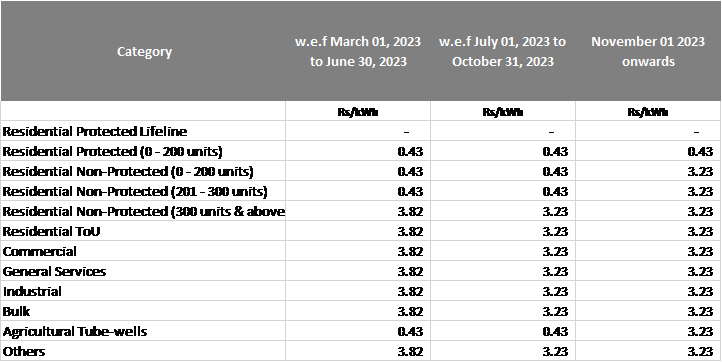

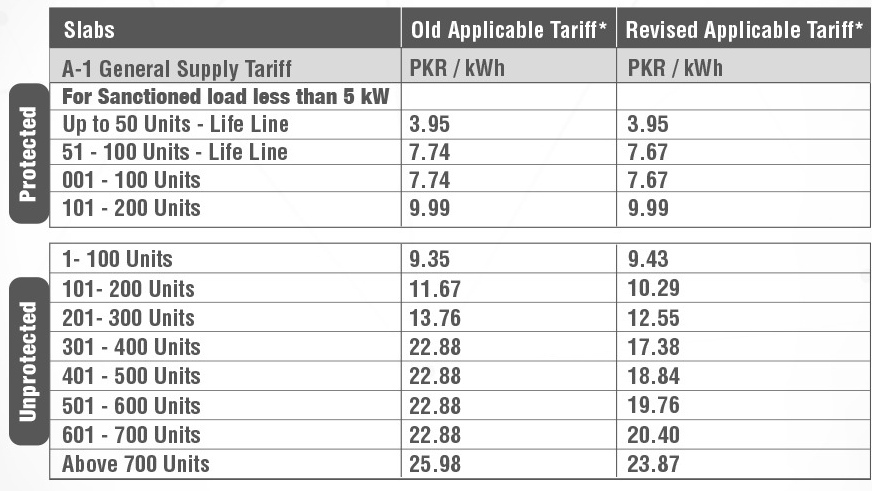

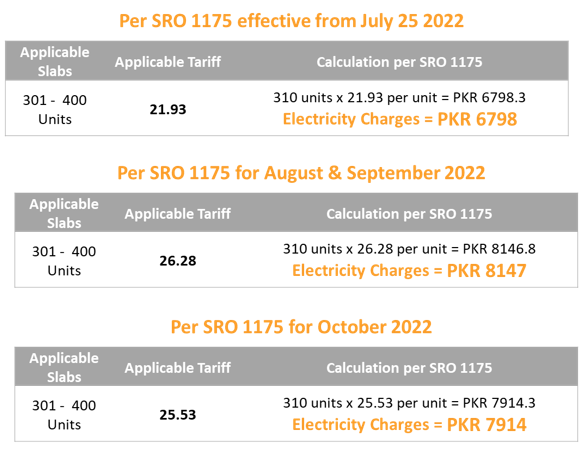

Per S.R.O. 1035(1)/2024 issued by the Government of Pakistan for Discos and KE effective July 1st, 2024:

- No change in Tariff till September 2024: If you use up to 200 units of electricity per month (for both protected and unprotected customers), there’s no change in your tariff rates till September 2024.

- Revised Tariff rates from October 2024: The electricity rates will be increased for both protected and unprotected customers using up to 200 units from October 1, 2024.

An overview of the electricity tariff changes for residential customers is given below:

| Jul -Sep 24 | Oct 24 onwards | ||||

|---|---|---|---|---|---|

| Residential Tariff | Old Tariff (Rs/Unit) | New Tariff (Rs/Unit) | New Tariff (Rs/Unit) | Fixed Charges (PKR/Con/M) | |

| PROTECTED | |||||

| 0 to 50 Units (Lifeline) | 3.95 | 3.95 | 3.95 | – | |

| 51 – 100 Units (Lifeline) | 7.74 | 7.74 | 7.74 | – | |

| 001 – 100 Units | 7.74 | 7.74 | 11.69 | – | |

| 101 – 200 Units | 10.06 | 10.06 | 14.16 | – | |

| UNPROTECTED | |||||

| 001-100 Units | 16.48 | 16.48 | 23.59 | – | |

| 101-200 Units | 22.95 | 22.95 | 30.07 | – | |

| 201-300 Units | 27.14 | 34.26 | 34.26 | – | |

| 301-400 Units | 32.03 | 39.15 | 39.15 | 200 | |

| 401-500 Units | 35.24 | 41.36 | 41.36 | 400 | |

| 501-600 Units | 36.66 | 42.78 | 42.78 | 600 | |

| 601-700 Units | 37.8 | 43.92 | 43.92 | 800 | |

| Above 700 Units | 42.72 | 48.84 | 48.84 | 1000 | |

| TOU (PEAK) | 41.89 | 48 | 48 | 1000 | |

| TOU (OFF – PEAK) | 35.57 | 41.68 | 41.68 | ||

Per S.R.O. 1035(1)/2024 issued by the Government of Pakistan, the increase in the base electricity tariff is effective from July 1st, 2024. The timing of its appearance on your bill depends on your billing cycle:

- If your July bill was generated after the official SRO announcement i.e. 12th July’24 onwards, it will reflect the revised tariff.

- In case your July bill was generated before official SRO announcement i.e. before 12th July’24, the new tariff has not been applied to you and you have been billed according to the older tariff. In this case, any difference between the old and new tariff will appear as arrears in your August bill.

Unprotected customers are customers whose sanctioned load is below 5 kW but who have consumed more than 200 units in any of the 6 months before their billing month. Their billing is based on slabs and their per unit cost of electricity is higher than protected consumers.

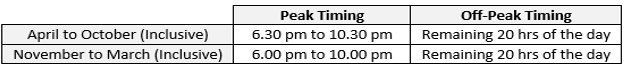

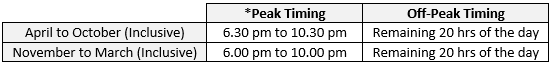

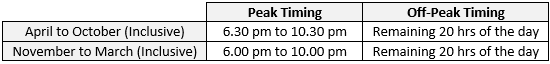

| April – October | 6:30 PM – 10:30 PM |

|---|---|

| November – March | 6:00 PM – 10:00 PM |

Off-Peak Timings are the remaining 20 hours. Please note that Peak and Off-Peak tariff is only applicable for customers who are billed according to Time-of-Use. These customers have a sanctioned load over 5 kW and 3-phase meters.

Electricity prices are determined by NEPRA (National Electric Power Regulatory Authority) and notified by the Government of Pakistan. Power Distribution Companies across Pakistan do not control the end-customer price-setting process, nor do they benefit from imposition of additional surcharges and taxes. All notifications are uploaded on NEPRAs website as well as KE Website. Please refer to: https://www.ke.com.pk/customer-services/tariff-structure/

| Comparison of Old & New Base Electricity Tariff (In PKR) | |||||

|---|---|---|---|---|---|

| Tariff Category | Old Base Tariff | Increase in base tariff | New base Tariff | Other Surcharges & Adjustments2 | What 1 unit will cost?1 |

| PROTECTED | |||||

| Up to 50 Units (Lifeline) | 3.95 | 0 | 3.95 | 0 | 3.95 |

| 51 – 100 Units (Lifeline) | 7.74 | 0 | 7.74 | 0 | 7.74 |

| 001 – 100 Units | 7.74 | 0 | 7.74 | 4.32 | 12.06 |

| 101 – 200 Units | 10.06 | 0 | 10.06 | 4.32 | 14.38 |

| UNPROTECTED | |||||

| 001 – 100 Units | 13.48 | 3 | 16.48 | 4.22 | 20.7 |

| 101 – 200 Units | 18.95 | 4 | 22.95 | 4.22 | 27.17 |

| 201 – 300 Units | 22.14 | 5 | 27.14 | 4.22 | 31.66 |

| 301 – 400 Units | 25.53 | 6.5 | 32.03 | 6.23 | 38.26 |

| 401 – 500 Units | 27.74 | 7.5 | 35.24 | 6.23 | 41.47 |

| 501 – 600 Units | 29.16 | 7.5 | 36.66 | 6.23 | 42.89 |

| 601 – 700 Units | 30.3 | 7.5 | 37.8 | 6.23 | 44.03 |

| Above 700 Units | 35.22 | 7.5 | 42.72 | 6.23 | 48.95 |

| TOU (PEAK) | 34.39 | 7.5 | 41.89 | 6.23 | 48.12 |

| TOU (OFF – PEAK) | 28.07 | 7.5 | 35.57 | 6.23 | 41.8 |

1 Exclusive of Taxes and other Government Charges

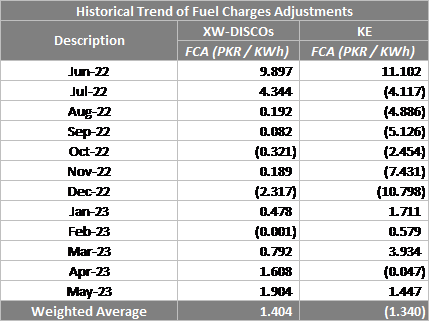

2 Includes PHL Surcharge, Uniform Quarterly Adjustment and Fuel Charge Adjustments Further Tax increased from 3% to 4% vide Finance, Act, 2023 applicable on non-tax filing commercial & industrial customers. Fuel Charge Adjustments and Uniform Quarterly Adjustments are based on multiple factors including fuel prices, fuel mix, demand, Exchange rates, capacity charges and other factors. Weak rupee, increase in fuel prices, higher interest rates and dependence on imported fuels have resulted in increase in FCA and Quarterly Tariff Adjustments. These amounts are applied to bills after rigorous scrutiny by NEPRA and decisions are published on NEPRA website. As fuel prices reduce internationally and access to indigenous fuels increase, power utilities pass the benefit to consumers. Please note Fuel Charge Adjustments are variable charges that are applied by NEPRA every month. Similary, Quarterly Tariff Adjustments are applied periodically after scrutiny and approval by NEPRA. The FCA charges included in the above table are applicable for July 2023 only. While the base tariff revision was notified on 27th July it became effective on 1st July. August bills will reflect this adjustment as arrears.

https://www.ke.com.pk/download/sro_for_discos_tariff_structure/TRF-100-XWDISCOS-KE-CORRIG.-OF-REVIEW-MOTION-27-07-2023-19644-62.pdf The impact of these tariff revisions has been calculated for you below:

| Comparison of Old & New Base Electricity Tariff (In PKR) | ||||

|---|---|---|---|---|

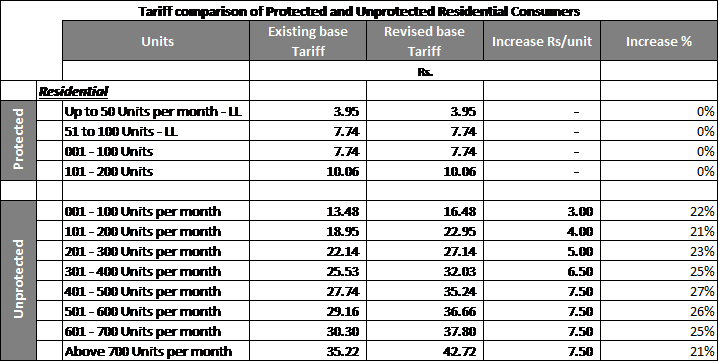

| Tariff Category | Old Base Tariff | Increase in base tariff | New Base Tariff | Increase in % |

| PROTECTED | ||||

| Up to 50 Units (Lifeline) | 3.95 | 0 | 3.95 | 0% |

| 51 – 100 Units (Lifeline) | 7.74 | 0 | 7.74 | 0% |

| 001 – 100 Units | 7.74 | 0 | 7.74 | 0% |

| 101 – 200 Units | 10.06 | 0 | 10.06 | 0% |

| UNPROTECTED | ||||

| 001 – 100 Units | 13.48 | 3 | 16.48 | 22% |

| 101 – 200 Units | 18.95 | 4 | 22.95 | 21% |

| 201 – 300 Units | 22.14 | 5 | 27.14 | 23% |

| 301 – 400 Units | 25.53 | 6.5 | 32.03 | 25% |

| 401 – 500 Units | 27.74 | 7.5 | 35.24 | 27% |

| 501 – 600 Units | 29.16 | 7.5 | 36.66 | 26% |

| 601 – 700 Units | 30.3 | 7.5 | 37.8 | 25% |

| Above 700 Units | 35.22 | 7.5 | 42.72 | 21% |

| TOU (PEAK) | 34.39 | 7.5 | 41.89 | 22% |

| TOU (OFF – PEAK) | 28.07 | 7.5 | 35.57 | 27% |

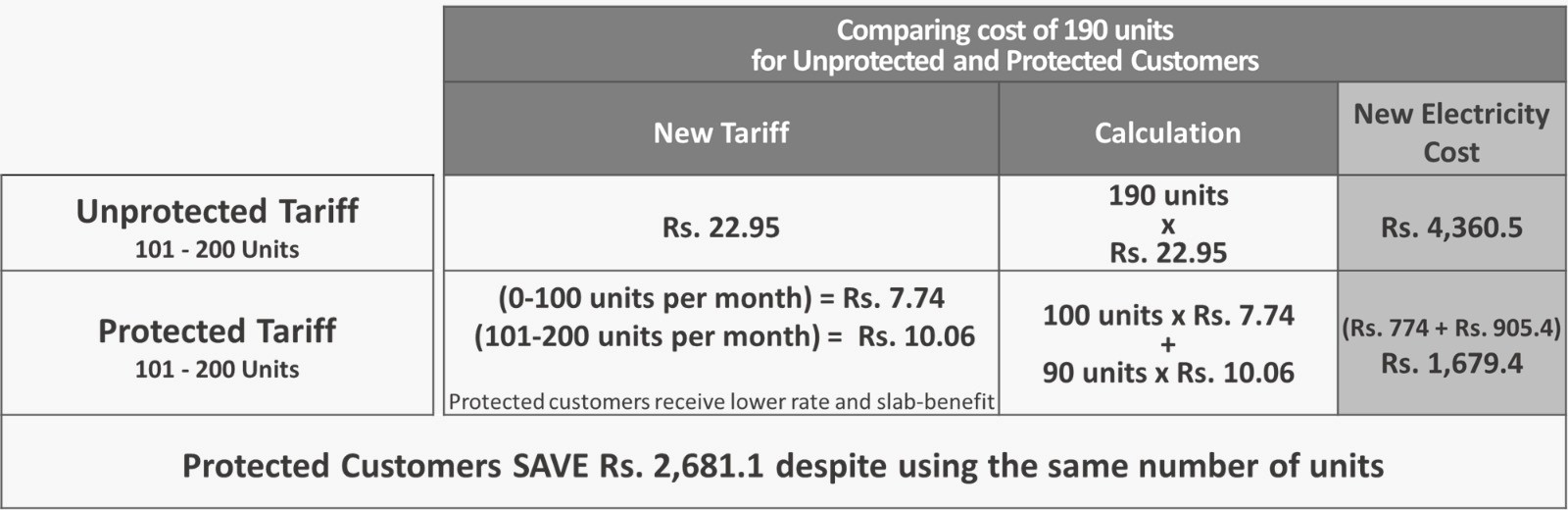

Unprotected customers are residential customers whose sanctioned load is below 5 kW but who have consumed more than 200 units in any of the 6 months before their billing month. The tariff revisions are applicable on them. Because they receive less subsidies than protected customers, their per unit cost of electricity is higher. The tariff differential for customers in protected and unprotected categories can be seen in the table below. Protected customers pay less than unprotected customers for the same electricity use on account of the higher subsidy that they receive from the government.

Difference in electricity charges for the consumption of 190 units between protected and unprotected customer categories is as below:

Difference in electricity charges for the consumption of 190 units between protected and unprotected customer categories is as below:

In line with the Government’s Uniform Tariff Policy, the electricity prices for K-Electric customers are the same as elsewhere in the country. Please note that these electricity prices are determined by NEPRA (National Electric Power Regulatory Authority) and notified by the Government of Pakistan. K-Electric or any other DISCO cannot make any changes to the electricity prices unilaterally. The base tariff determination for K-Electric and other Discos is available on NEPRA website: https://nepra.org.pk/tariff/Tariff/Ex-WAPDA%20DISCOS/2023/TRF-100%20Review%20filed%20by%20Federal%20Govt%2XXX-XX-2023%2019271-90.PDF

https://www.ke.com.pk/download/sro_for_discos_tariff_structure/TRF-100-XWDISCOS-KE-CORRIG.-OF-REVIEW-MOTION-27-07-2023-19644-62.pdf

| April – October | 6:30 PM – 10:30 PM |

|---|---|

| November – March | 6:00 PM – 10:00 PM |

Off-Peak Timings are the remaining 20 hours. Please note that Peak and Off-Peak tariff is only applicable for customers who are billed according to Time-of-Use. These customers have a sanctioned load 5 kW or above and 3-phase meters.

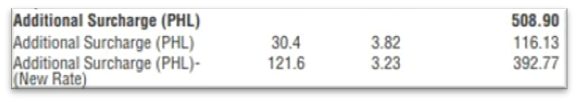

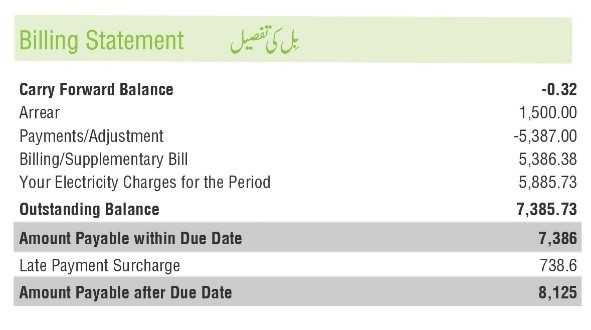

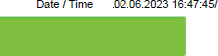

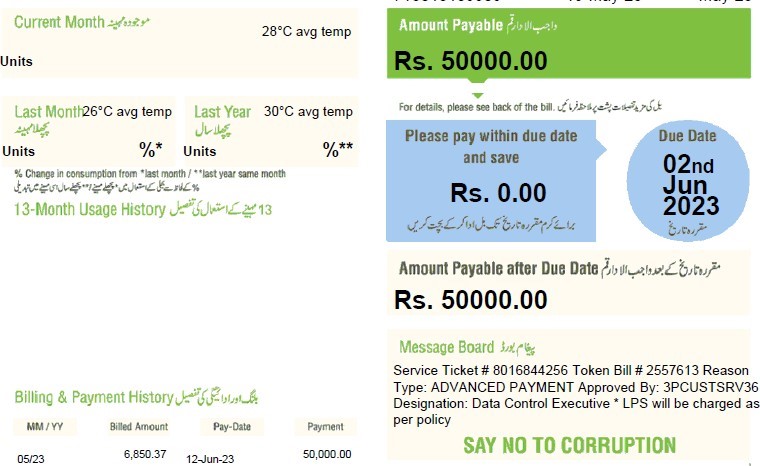

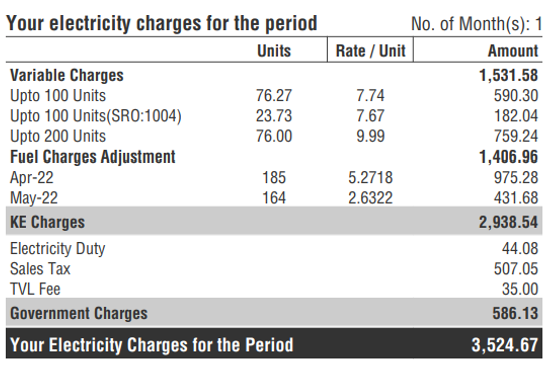

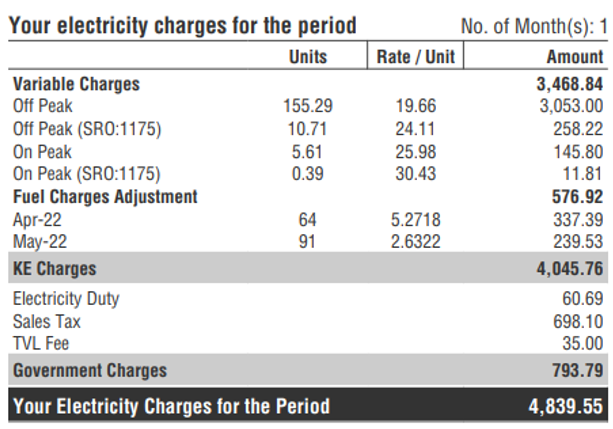

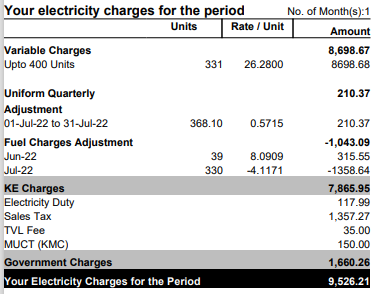

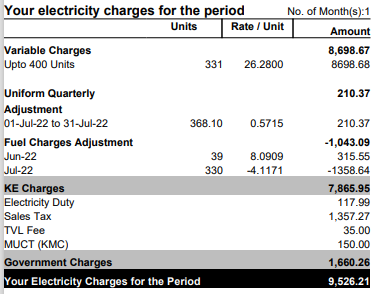

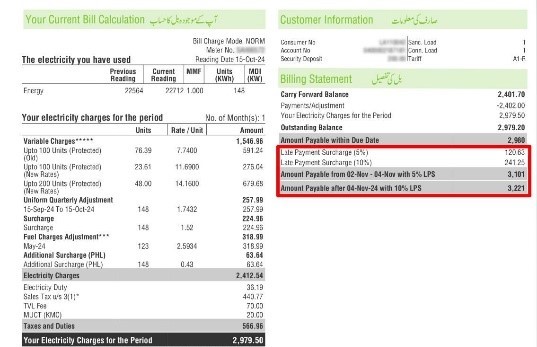

Sample image of Bill:

Sample image of Bill:  * PHL stands for Power Holding Limited established for funding of power sector payables. The amount generated from the above-mentioned surcharge will be utilized to pay off the mark-up charges of PHL loans.

* PHL stands for Power Holding Limited established for funding of power sector payables. The amount generated from the above-mentioned surcharge will be utilized to pay off the mark-up charges of PHL loans.

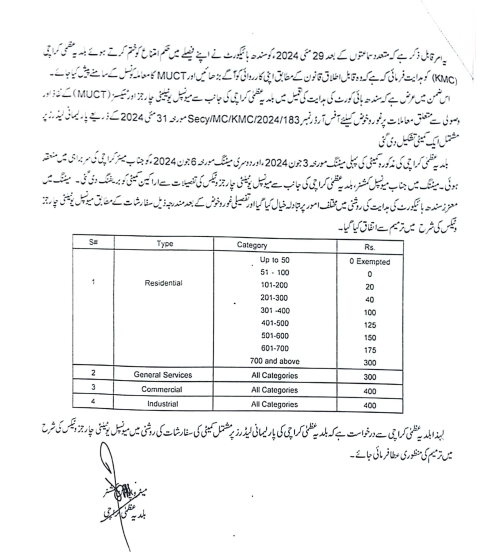

| S. # | Type | Category | Rs. |

|---|---|---|---|

| 1 | Residential | Up to 50 Units | 0 Exempted |

| 51-100 Units | 0 | ||

| 101-200 Units | 20 | ||

| 201-300 Units | 40 | ||

| 301-400 Units | 100 | ||

| 401-500 Units | 125 | ||

| 501-600 Units | 150 | ||

| 601-700 Units | 175 | ||

| 700 Units and Above | 300 | ||

| 2 | General | All Categories | 300 |

| 3 | Commercial | All Categories | 400 |

| 4 | Industrial | All Categories | 400 |

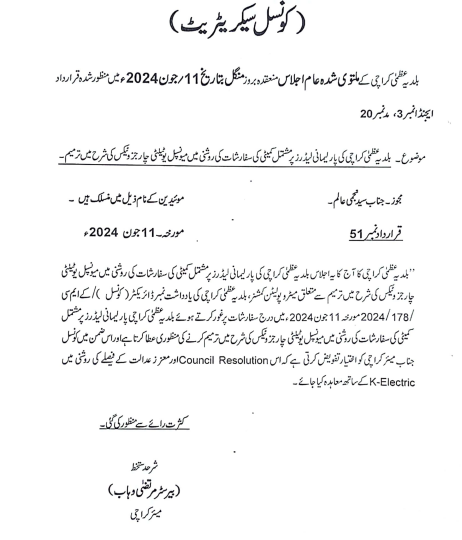

The KMC Resolution dated 11th June 2024 bearing reference no. 51 is attached below:

Agriculture: Consumers predominantly engaged in agriculture activities by using land for the production or raising of crops, poultry, or livestock.

Streetlight: supply for the purpose of illuminating public lamps.

Bulk Supply: Supply given at one point for self-consumption not selling any other consumer such as residential, commercial, tube-well and others.

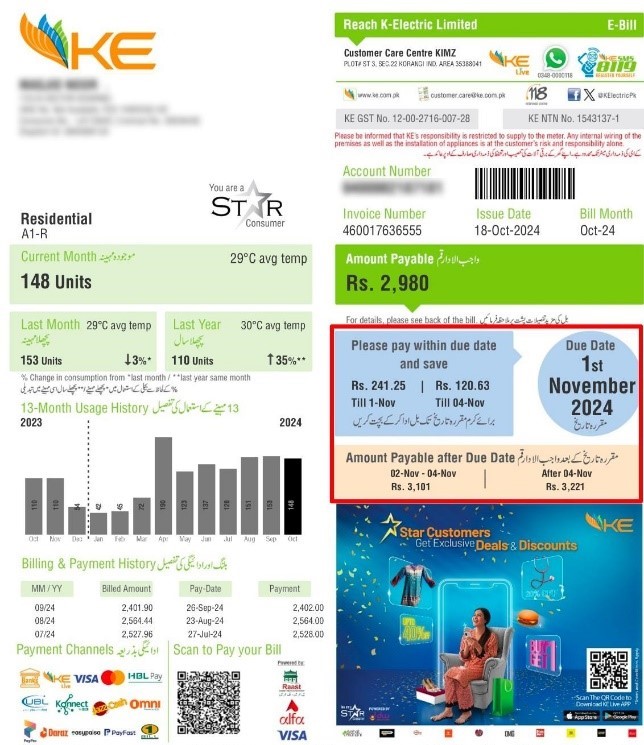

- You must be a Star Customer. (Customer who have regularly paid their electricity bills for 11/12 months)

- Advance payment billing amount > last current bill amount.

- No outstanding balance at the time of advance bill generation.

- You must apply for an advance bill at least 7 days prior to the bill generation date. You can check your bill generation date on the top right of your bill.

- By visiting nearest bank.

- Via Internet Banking (Meezan/Askari)

- Keep track of your payments

- Eliminating the need for physical bills or payment receipts for record-keeping and accounting

- Conveniently shift to e-billing (https://www.ke.com.pk/customer-services/e-billing/)

- and never worry about filing

- Cut down your paper footprint and help save trees and water

- “Paid” stamp is Green and indicates that the exact bill amount for the month has been paid

- “Payment Received” stamp is Blue and indicates that the payment received against the current bill may be different from the amount mentioned on the bill.

These stamps provide customers with a clear visual indicator of their bill status and payment history averting any confusion or disputes.

- Status: “Paid” or “Payment Received” respectively indicate whether the amount paid is the same or different from the amount mentioned on the bill

- Amount Paid: The exact amount that was paid at the payment channel

- Payment Date: The date that the payment was made to the payment channel

- Payment ID details: Mentions the transaction ID against which the payment may be tracked

Q 6. For how many months can I view the digital stamp on my paid KE bills after they have been paid?

- Preserving 4200 trees and off-setting 94 tonnes of CO2

- Saving 265 million liters of water

- Preventing 92 tonnes of paper-based waste from entering Karachi’s landfills

- Preserving 4200 trees and off-setting 94 tonnes of CO2

- Saving 265 million liters of water

- Preventing 92 tonnes of paper-based waste from entering Karachi’s landfills

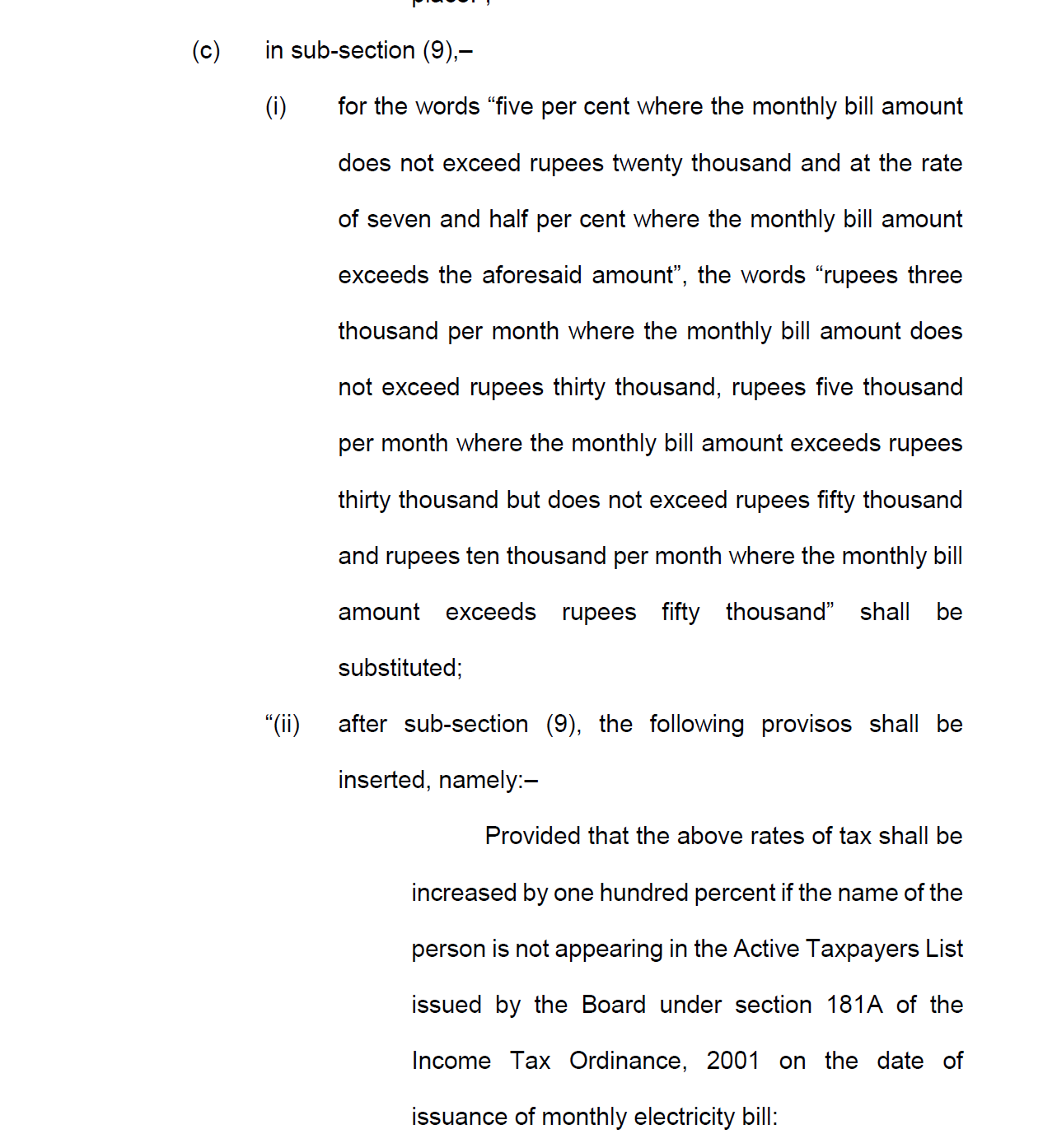

Sales Tax on Retailers effective 1st August

Per Finance Act, 2022 the Federal Government revised the applicable Sales Tax on Retailers with effect from 01st July 2022. Thus, electricity bills for July were charged Sales Tax according to the following slabs.

| Amount of Monthly Bill (PKR) | Sales tax on Unregistered Retailers (PKR) | |

|---|---|---|

| Active Taxpayer* | Inactive Taxpayer* | |

| 0 – 30,000 | 3,000 | 6,000 |

| 30,001 to 50,000 | 5,000 | 10,000 |

| Above 50,000 | 10,000 | 20,000 |

In line with the recent announcement by the Ministry of Finance & Revenue for the reversal of the Fixed Sales Tax Scheme, Sales Tax on Retailers has been revised w.e.f. 1 July 2022 to the mechanism followed before Finance Act 2022. Please note that this is subject to necessary legislation. In line with the minutes of meeting issued by the Federal Board of Revenue (FBR) dated August 05, 2022, upcoming bills will be issued with Sales Tax amount on Retailers per the below rates as were applicable prior to Finance, Act, 2022:

| Amount of Monthly Bill (PKR) | Rate of Sales Tax on Retailers |

|---|---|

| Up to 20,000 | 5% |

| Above 20,001 | 7.5% |

Please note: KE is revising the bills for July 2022 and is issuing the bills for August 2022 in the light of the announcement speech of Finance Minister and FBR minutes of meetings dated August 05, 2022. Therefore, KE has reserved the right to further revise these bills if required in the light of the amendments in the sales tax law which we expect to be issued by the Federal Government in due course. Please note that K-Electric only acts as a collecting agent on behalf of the Federal and Provincial Governments and that taxes collected through electricity bills are deposited with them and are outside of KE purview.

In line with the recent announcement by the Ministry of Finance & Revenue for the reversal of the Fixed Sales Tax Scheme, Sales Tax on Retailers has been revised w.e.f. 1 July 2022 to the mechanism followed before Finance Act 2022.

If you have already paid your July 2022 bill Don’t worry if you have already paid sales tax through your July 2022 electricity bill Per Finance Act, 2022 Sales Tax on Retailers for both July and August will be calculated/re-adjusted per the mechanism followed prior to amendments made through Finance Act 2022 (subject to necessary legislation). Any amount paid in July 2022 over and above this calculation, will be adjusted against your August Energy Charges and you will only have to pay the differential amounts. To understand how the charges will be calculated, please see the example below:

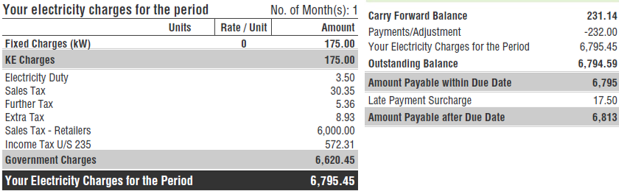

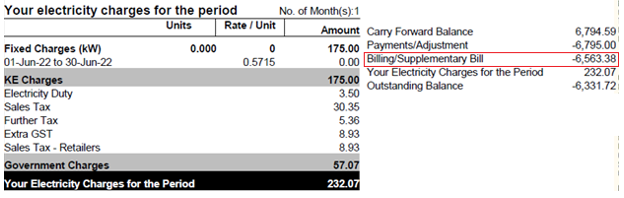

JUL-22:

AUG-22:

Calculation:

Calculation:

| Bill of July-22 (Per Finance Act 2022) | Bill of July-22 (Revised to Methodology Prior Finance Act 2022) | ||

|---|---|---|---|

| Current month consumption (Variable Charges) | 175 | Current month consumption (Variable Charges) | 175 |

| Electricity Duty (2%) | 4 | Electricity Duty (2%) | 4 |

| Sales Tax (17%) | 30 | Sales Tax (17%) | 30 |

| GST Further (3%) | 5 | GST Further (3%) | 5 |

| Extra Tax (5%) | 9 | Extra Tax (5%) | 9 |

| Sales Tax – Retailers | 6,000 | Sales Tax – Retailers (5%) | 9 |

| Income Tax U/S 235 | 572 | Income Tax U/S 235 | – |

| Total Electricity Charges for the month | 6,795 | Total Electricity Charges for the month | 232 |

| Difference | (6,563) | ||

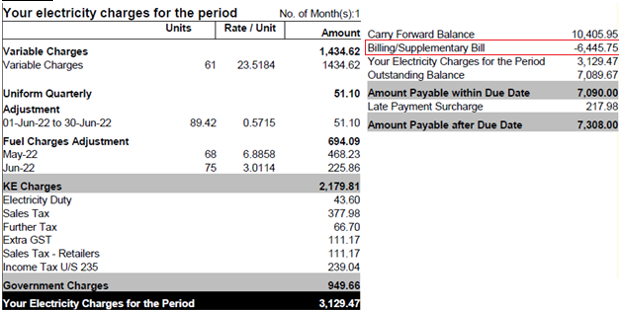

If I haven’t paid your July 2022 bill In case your July bill has not yet been paid, then please wait to receive your August 2022 bill. The tax charges for both July and August in this bill will be calculated per the mechanism followed before Finance Act 2022. As an additional facilitation, KE has waived Late Payment Surcharge for the unpaid July 2022 bills subject to the condition that both July (outstanding) and August (current) bills are paid within your August 2022 due date (mentioned on the bill). In case payment is not received within the August due date, Late Payment Surcharges for both July and August will be applicable. Customers will also be sent an SMS with a bitly link to their August 2022 should they wish to pay online through a wide variety of payment options https://www.ke.com.pk/customer-services/billls-and-e-payments/ . Your revised bill may look like the below:

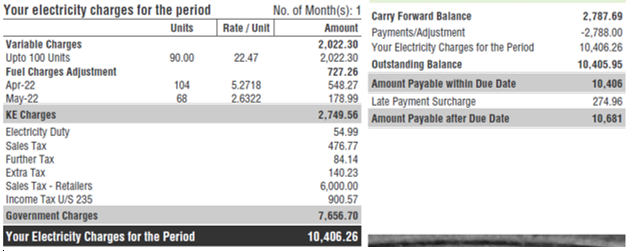

JUL-22:

AUG-22:

Calculation:

| Bill of July-22 (Per Finance Act 2022) | Bill of July-22 (Revised to Methodology Prior Finance Act 2022) | ||

|---|---|---|---|

| Current month consumption (Variable Charges) | 2,022 | Current month consumption (Variable Charges) | 2,022 |

| FCA | 727 | FCA | 727 |

| Electricity Duty (2%) | 55 | Electricity Duty (2%) | 55 |

| Sales Tax (17%) | 477 | Sales Tax (17%) | 477 |

| GST Further (3%) | 84 | GST Further (3%) | 84 |

| Extra Tax (5%) | 140 | Extra Tax (5%) | 140 |

| Sales Tax – Retailers | 6,000 | Sales Tax – Retailers (5%) | 140 |

| Income Tax U/S 235 | 901 | Income Tax U/S 235 | 315 |

| Total Electricity Charges for the month | 10,406 | Total Electricity Charges for the month | 3,960 |

| Difference | (6,446) | ||

As a customer facilitation, KE has waived Late Payment Surcharge for the unpaid July 2022 bills subject to both July (outstanding) and August (current) bills being paid within your August due date (mentioned on the bill). In case payment is not received within the August due date, Late Payment Surcharges for both July and August will be applicable.

If you feel that the adjustment on your bill is erroneous, please call 118 or visit your nearest customer care center to understand the calculation. If I haven’t consumed any electricity in the current month, how will my Sales Tax amount be adjusted? In case your electricity consumption in the current month is zero, in such case the differential amount will be accredited in your next electricity bill.

Sales Tax on Retailers effective 1st July

| Amount of Monthly Bill (PKR) | Sales tax on Unregistered Retailers (PKR) | |

|---|---|---|

| Active Taxpayer* | Inactive Taxpayer* | |

| 0 – 30,000 | 3,000 | 6,000 |

| 30,000 to 50,000 | 5,000 | 10,000 |

| Above 50,000 | 10,000 | 20,000 |

* under the Income Tax Ordinance, 2001 The Finance, Act 2022, can be download from the FBR website. Click HERE to download [Page No. 13]. Section 3(9) of the Sales Tax Act, 1990

Prior to Finance Act, 2022 The applicable sales tax on retailers prior to Finance Act, 2022 was as follows: Amount of Monthly Bill (Rs.)Rate of Sales Tax on Retailers

| Upto 20,000 | 5% |

| Above 20,001 | 7.5% |

A person who not only duly files his/her income tax returns but whose name also appears on the Active Taxpayers List (ATL) issued/updated by Federal Board of Revenue (FBR). Click HERE to check your Active Taxpayer status on the FBR website. Per the revision in Sales Tax on Retailers, customers whose names do not appear in the ATL will be charged a higher rate than those whose names appear on the ATL list.

Q 8. Will I be charged Sales Tax even if my shop is vacant or if my electricity consumption is zero?

Per the Finance Act 2022 by the Federal Government, a minimum of PKR 3,000/- Sales Tax will be applied on Retailers who are also Active Taxpayers under the Income Tax Ordinance, 2001. The amount will be double in case customers are not listed on FBR’s website as Active Taxpayer.

Taxes are controlled and collected by various Government entities / FBR as and when notified. K-Electric only acts as a collecting agent on behalf of the Government. Collected taxes are deposited with the government agency that has enforced them and are outside of KE purview.

Per Sales Tax Act 1990, Sales Tax on Retailers is not applied on electricity bills if customer is registered retailer under the Sales Tax Act, 1990 and details appear in Federal Board of Revenue’s (FBR) Active Taxpayer List (ATL). Customers can check their particulars on the FBR website HERE by selecting Taxpayer Profile Inquiry. The customer can also approach the concerned Commissioner of Inland Revenue to issue order for exclusion as a Retailer. Retailers can minimise their Sales Tax by providing their CNIC, NTN and/or STRN (if applicable) and other details to their electricity provider.] *If you are an Active Taxpayer and/or a Registered Retailer per the FBR website AND your KE account name and address is the same as the name and address on your CNIC or/and NTN /STRN, please immediately share a scanned copy of CNIC and NTN / STRN with us. You may also visit a KE Customer Care Centre with a copy of your valid CNIC, NTN and STRN certificates and your KE Account Number.

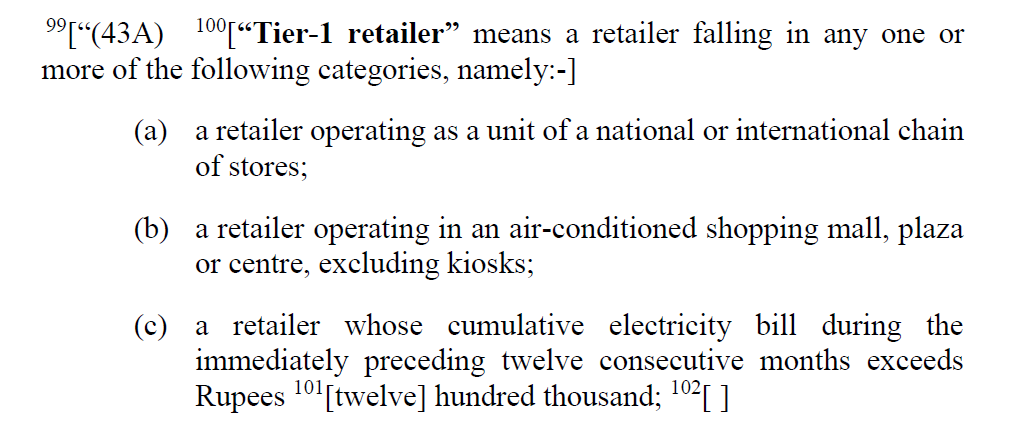

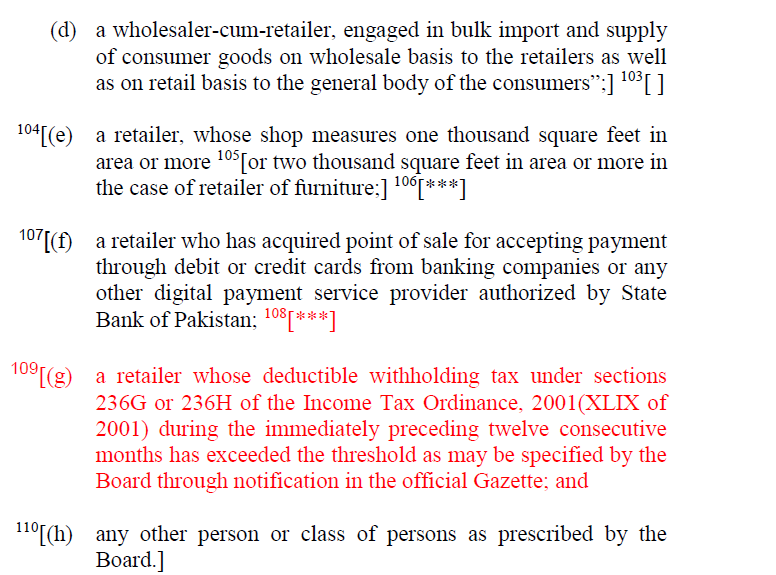

In terms of Section 2(43A) of the Sales Tax Act, 1990, following retailers are required to obtain registration under the Sales Tax Ac, 1990.

Changes inserted vide Finance Act, 2022

In case you feel that the Sales Tax on Retailers has been charged erroneously on your electricity bill despite updated CNIC, NTN and/or STRN (if applicable) details with KE and inclusion in the FBR’s Active Taxpayer List, please immediately visit your closest Customer Care Centre for correction of the bill. Alternatively, you may write to us at tariff.helpdesk@ke.com.pk. We will aim to rectify any mistake within 10 working days. In case you are not a Retailer and have been charged this Sales Tax, please update your details in KE’s database HERE. You can also approach the Concerned Commissioner of Inland Revenue to obtain an order for exclusion as retailer.

In case the name appearing on the KE bill differs from the name appearing on the NTN and/or STRN, then KE can update the User section of the of the electricity bill with your name and CNIC, NTN, STRN details only if your KE billing address matches the address mentioned on your CNIC / NTN and/or STRN. Please upload a scanned copy of your documents HERE along with your KE customer account details

Please apply for a Change of Name to update the KE bill. Visit your nearest IBC and submit the duly filled form along with the registered sale deed (ownership proof), attested copy of your CNIC, NOC from previous owner, a copy of your last paid bill (evidencing that no arrears are pending) and Undertaking at any KE Customer Care Centre. You may also apply for a Change of Name online via:

The KE Live App

- https://www.ke.com.pk/live-playstore (Google Play)

- https://apps.apple.com/pk/app/ke-live/id1458106362 (App Store)

KE Live Web Portal

The Change of Name process may take up to nineteen (19) working days. You will receive a confirmation of completion via SMS. We will update your user account details on receipt of your complete request.

Retailers can minimise their Sales Tax by providing their CNIC or NTN and/or STRN (if applicable) and other details to their electricity provider. Click HERE to update your details in the KE system.* *If you are an Active Taxpayer and/or a Registered Retailer per the FBR website [check HERE by selecting Taxpayer Profile Inquiry] AND your KE account name and address is the same as the name and address on your CNIC and NTN /STRN, please immediately share a scanned copy of CNIC and NTN / STRN with us. You may also visit a KE Customer Care Centre with a copy of your valid CNIC, NTN and STRN certificates and your KE Account Number.

No, Sales Tax on Retailers paid under Sales Tax Act, 1990 will be treated as discharge of tax liability under the Income Tax Ordinance, 2001 under Section 99A of the Income Tax Ordinance, 2001.

Yes. Sales Tax on Retailers is in addition to aforesaid taxes.

If you are a retailer operating from a rented premises and the address of the premises on your NTN and/or STRN matches the billing address mentioned on the KE Bill, then upload scanned copy of your CNIC or/ NTN and/or STRN HERE along with your KE customer account details to update the User details (name and CNIC) on KE bill.

The address on your NTN / STRN must match the address mentioned on your KE bill for your user account details to be updated and for you to be eligible for the Sales Tax on Retailers reduction/exemption. You can conveniently update your details online in the FBR system HERE.

Customers whose details have been updated in the KE system shall receive an auto-generated SMS confirming the update. In addition their CNIC, NTN and/or STRN shall be printed on the next bill that they receive.

Yes, if the owner or tenant are a tax-filer and/or a registered retailer and the address on the NTN and/or STRN match the address printed on the KE electricity bill.

| SRO 1004 | July 07, 2022 |

| SRO 1175 | July 25, 2022 |

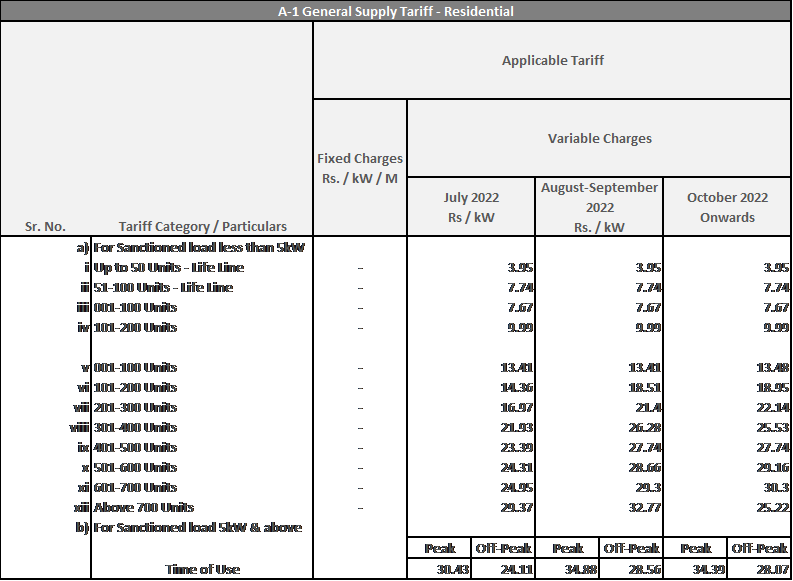

Per SRO 1004 by Ministry of Energy, Residential Tariff Slabs and Calculation Methodology were revised for Residential customers billed under the Slab model from July 07, 2022. Click HERE to see the SRO.

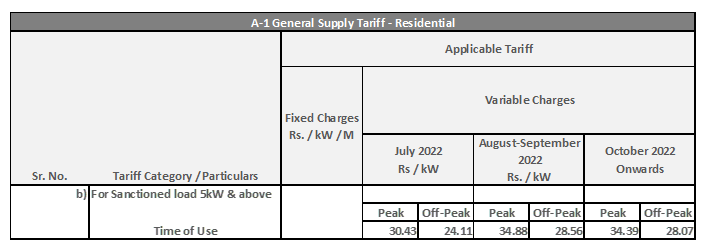

Prior to this SRO, one-slab benefit for Unprotected category was allowed and consumption was divided in current and one previous slab. This mechanism has now been withdrawn & consumption will be charged within a single slab only. SRO 1004 has now been superseded by SRO 1175 which was notified by the Ministry of Energy for customers of K-Electric from July 25, 2022 onwards wherein the tariff rates have been further revised. Based on this SRO, tariff has been revised for all Residential customer categories i.e. customers billed under Consumption Slab model and customers billed under the Time of Use model. Click HERE to see the SRO. Per the SRO which ensures uniformity of tariffs across Pakistan, electricity prices per unit for residential customers billed under the Unprotected slabs and the Time of Use mode will increase on July 25, 2022, followed by subsequent revision on August 01, 2022 and October 01, 2022.

Prior to this SRO, one-slab benefit for Unprotected category was allowed and consumption was divided in current and one previous slab. This mechanism has now been withdrawn & consumption will be charged within a single slab only. SRO 1004 has now been superseded by SRO 1175 which was notified by the Ministry of Energy for customers of K-Electric from July 25, 2022 onwards wherein the tariff rates have been further revised. Based on this SRO, tariff has been revised for all Residential customer categories i.e. customers billed under Consumption Slab model and customers billed under the Time of Use model. Click HERE to see the SRO. Per the SRO which ensures uniformity of tariffs across Pakistan, electricity prices per unit for residential customers billed under the Unprotected slabs and the Time of Use mode will increase on July 25, 2022, followed by subsequent revision on August 01, 2022 and October 01, 2022.

Per SRO 1175 which was notified by the Ministry of Energy for customers of K – Electric from July 25, 2022 onwards, revised tariffs are applicable for all customer categories including Commercial, Industrial and Residential. Click HERE to see the SRO. Accordingly, electricity prices per unit for all the customers (excluding Protected consumers) will increase from July 25, 2022, followed by subsequent revision on 1st August 2022 and 1st October 2022.

Per Tariff terms and conditions approved by NEPRA, Residential customers with sanctioned load below 5 kW are billed based on their consumption slab according to Tariff rates notified by the Government of Pakistan. [You can check your sanctioned load on the top right corner on the back of the KE bill].

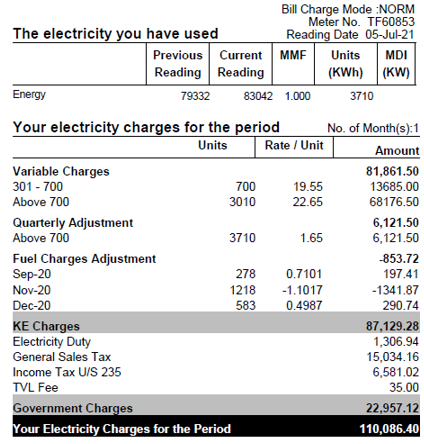

Similarly, your bill calculation [on the back of the bill] will clearly mention units consumed and the slab that they have been billed under:

Similarly, your bill calculation [on the back of the bill] will clearly mention units consumed and the slab that they have been billed under:

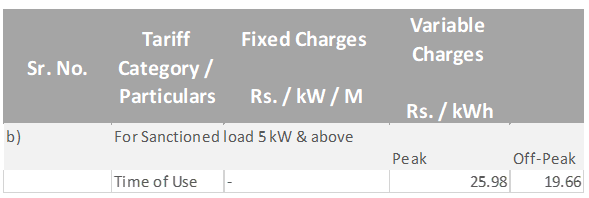

Residential customers whose Sanctioned Load is 5kW or above are billed under a Time of Use mode. As such your bill calculation will show your electricity unit consumption based on Peak and Off-Peak hours.

Residential customers whose Sanctioned Load is 5kW or above are billed under a Time of Use mode. As such your bill calculation will show your electricity unit consumption based on Peak and Off-Peak hours.

This is the application of tariff according to the time in which energy is consumed. These rates vary by time of day: more expensive during peak demand hours and less expensive during low demand periods. TOU has been implemented across all Distribution Companies (DISCOs) across Pakistan to encourage responsible consumer consumption and ease the strain of energy usage during maximum demand periods. Billing for eligible customers will be based on their consumption during peak/off-peak hours which are as per below:

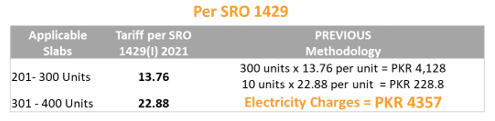

As both SRO 1004 and SRO 1175 have been notified by Ministry of Energy for Slab-based Residential Customers for July, your electricity bill for July may look a little different than usual. You may see at least two and up to three separate tariff entries on account of SROs 1429, 1004 and 1175 respectively. Click on the hyperlinks to check these SROS. Your consumption prior to July 07, 2022 has been charged per the previous slab structures under SRO 1429 dated November 5, 2021 & one slab benefit has been provided for this consumption. Consumption from July 07 to July 24, 2022 has been charged according to the revised slabs and calculation methodology per SRO 1004 by the Ministry of Energy notified on July 07, 2022. Your energy consumption has now been calculated without benefit of one slab as the same has been withdrawn. However, protected residential consumers (excluding lifeline consumers) will still get one slab benefit. Consumption from July 25 to July 31, 2022 will be charged according to the revised tariff slabs per SRO 1175 which was notified by Ministry of Energy on July 25, 2022. The removal of slab benefit implemented through SRO 1004 will be continued.

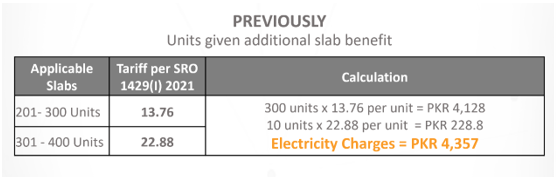

Per SRO 1429(I)/2021 applicable till July 06, 2022, residential customers billed under the Slab mode received one slab benefit by being billed in 2 slabs. The calculation for 310 units with the slab benefit looked like:

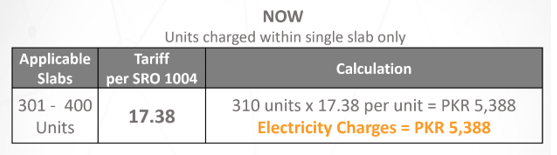

Residential Tariff Slab calculation methodology has been changed per SRO 1004 notified by Ministry of Energy on July 07, 2022 and the benefit of one previous slab has been withdrawn for Unprotected Residential customers. The calculation for 310 units without the slab benefit will look like:

Residential Tariff Slab calculation methodology has been changed per SRO 1004 notified by Ministry of Energy on July 07, 2022 and the benefit of one previous slab has been withdrawn for Unprotected Residential customers. The calculation for 310 units without the slab benefit will look like:

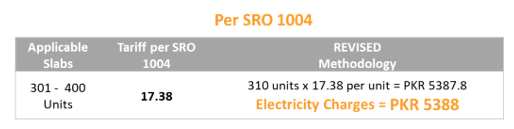

In addition, tariff rates have been revised per SRO 1175 which was notified by Ministry of Energy on July 25, 2022. The calculation for 310 units of electricity for July, August and October will now be:

In addition, tariff rates have been revised per SRO 1175 which was notified by Ministry of Energy on July 25, 2022. The calculation for 310 units of electricity for July, August and October will now be:

Consumption from 25th July onwards will be charged according to the revised tariff slabs per SRO 1175

Consumption from 25th July onwards will be charged according to the revised tariff slabs per SRO 1175

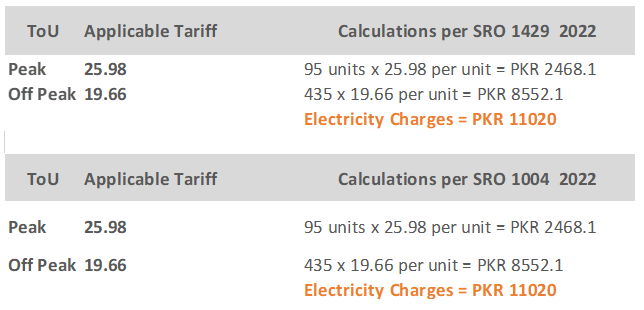

Customers are billed under the Time of Use model through special TOU meters installed at their premises. These track electricity consumption during both Peak and Off-peak hours. These units are then respectively billed against applicable Peak and Off-peak tariffs per the applicable SROs. Time of Use rates under SRO 1429 and SRO 1175 (ToU rates were same in both the SROs) were applicable for TOU Residential Customers till July 24, 2022. Electricity charges under these SROs for 95 Peak-hour units and 435 Off-Peak hour units looked like:

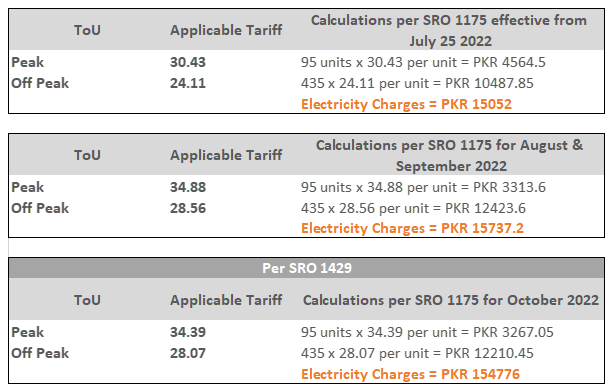

Time of Use rates been revised per SRO 1175 which was notified by Ministry of Energy on July 25, 2022. Electricity charges under this SRO for 95 Peak-hour units and 435 Off-Peak hour units for July, August & September, and October will now be:

Time of Use rates been revised per SRO 1175 which was notified by Ministry of Energy on July 25, 2022. Electricity charges under this SRO for 95 Peak-hour units and 435 Off-Peak hour units for July, August & September, and October will now be:

One slab benefit refers to the billing mechanism where the total units of electricity consumed are divided into two slabs i.e., the current slab and one previous slab. As an example, the calculation for 310 units of electricity with one slab benefit was:

Per SRO 1004 notified by Ministry of Energy dated July 7, 2022, with the removal of one slab benefit the total consumption will be billed in current slab only. The calculation for 310 units of electricity with withdrawal of one slab benefit will now be:

Per SRO 1004 notified by Ministry of Energy dated July 7, 2022, with the removal of one slab benefit the total consumption will be billed in current slab only. The calculation for 310 units of electricity with withdrawal of one slab benefit will now be:

The tariff rates have been further revised on July 25, 2022 as per SRO 1175.

The tariff rates have been further revised on July 25, 2022 as per SRO 1175.

As per Tariff Terms & Conditions approved by NEPRA and notified by GoP dated November 5, 2021 “Protected customers” refers to Non-ToU Residential customers consuming less than or equal to 200 units per month consistently for the past 6 months. All other Non-ToU Residential customers (with sanctioned load below 5 kW) who don’t fall under the protected category would be categorized as Unprotected Customers as per the Tariff Terms & Conditions.

The revised tariff rates per SRO 1175 are applicable on all the consumers of K-Electric effective from July 25, 2022.

We know these are difficult times; that’s why we wanted to give notice before these costs are seen on bills so that you can take necessary conservation steps to reduce their impact. It is important to emphasise that reducing energy wastage and conserving electricity are proven routes to controlling your bill. Follow @KElectricpk on Facebook for energy conservation tips and tricks. For customers billed under the TOU mode, consciously limiting non-essential consumption (operating water-motors, ironing clothes etc.) during Peak-hours can make a big difference to your electricity bills. Further, to support customers during this time, we are partnering with various financial entities to offer rebates and various flexible payment options that may support during this time.

Zero-Rated Industrial Support Package (ISPA)

Per direction by Government of Pakistan dated September 10, 2021, Export oriented industries were provided relief by restricting their electricity rates to US 9 cents per kWh till June 30, 2022. With no further extension by GoP, this relief was discontinued with effect from 1st July 2022, and Export-oriented Industries were charged as per their actual tariff categories for the month of July 2022. However, based on the letter of GoP dated August 12, 2022, the relief of concessionary tariff has been implemented again restricting the electricity rates to US 9 cents per kWh effective 1st August 2022.

Effective January 1, 2021, a standard operating procedure (SOP) was devised and notified on December 30, 2020 by FBR after due as per ECC direction dated Dec 2, 2020 in consultation with Ministry of Commerce and other stakeholders for registration of new manufacturers for concessionary tariff rates (i.e. US 9 cents per kWh). Main features of the SOP are as under:

- For new registration, applicants may apply through their representative Associations (for e.g: APTMA, PTEA, PHMA etc.).

- The Association, after proper verification, may forward the application to the Export-Oriented Sector Registration Cell (ESRC) of FBR, as per specified format duly signed by Chairman Association.

- ESRC after due examination and re-verification shall forward the application to the Ministry of Commerce while any discrepancy, if any, identified by ESRC shall be referred to FBR field teams.

- On receipt of direction from Ministry, DISCOs shall charge the concessionary tariff in case the taxpayer is an active taxpayer. Standard tariff would be charged if the taxpayer is not an active taxpayer for the relevant period.

- Any taxpayer not registered with respective Association may approach FBR field teams for verification of its business particulars and for onward submission of report to ESRC.

- The newly enrolled taxpayer shall be entitled to avail concessionary tariff prospectively.

Yes, these changes are applicable nationally based on GoP’s uniform tariff policy subject to approval of Federal Government and the above SOP.

Your tax liability will also be increased as per your electricity consumption.

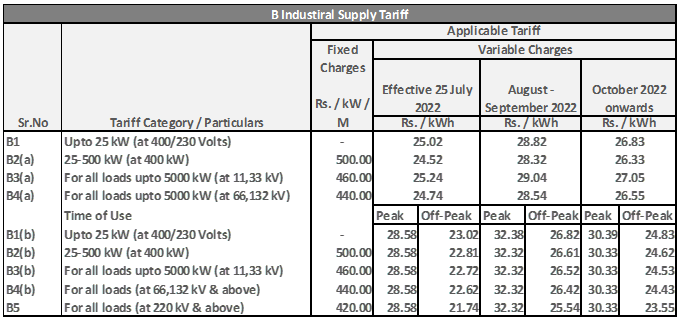

Per SRO 1175 for Industrial Customers

In addition to this tariff notification, two additional changes will impact industrial customers bills from July onwards.

In addition to this tariff notification, two additional changes will impact industrial customers bills from July onwards.Removal of Peak Hour Relief for Industrial consumers: Industrial customers were provided relief in form of charging their Peak Hours utilization at Off-Peak Rates nationally. This relief was initially effective from 1st November 2020, till 30th April 2021; it was further extended till 30th June 2022 by NEPRA’s decision dated June 17, 2021. As there has been no further notice of extension, with effect from 1st July 2022, Industrial customers across Pakistan will be charged at the Peak Rate for their Peak hours utilization. This change will reflect in the July bill onwards.

Removal of Zero-Rated Industrial Support Package (ZRISPA): Per direction by Government of Pakistan dated 10th September 2021, export-oriented industries nationally were provided relief by restricting their electricity rates to US cent 9 per kWh till June 30, 2022. With no further extension by GoP, this support has been discontinued with effect from 1st July 2022, and Export-oriented Industries will now be charged as per their actual tariff categories, until any further notice by GoP.

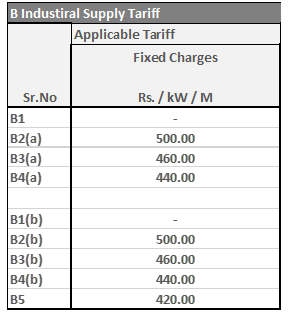

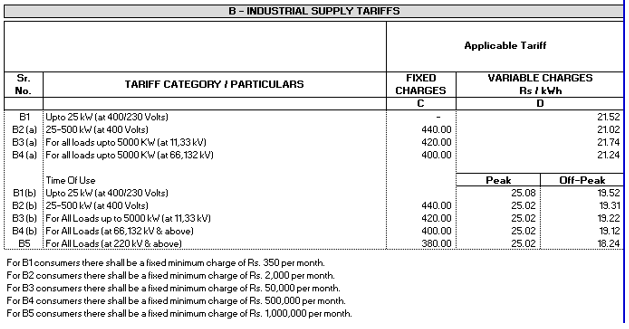

Per SRO 1175 dated 25th July 2022, both the applicable rates of Fixed Charges and the charging mechanism have been revised. Fixed charges will now be charged based on either Maximum demand in the month or 50% of sanctioned load, whichever is higher. In case where fixed charges will be based on above mechanism, “fixed minimum charges” will be removed. For B1 Customers, there will be a fixed minimum charge of PKR 350 per month, same as in previous SRO.

For B1 consumers there shall be a fixed minimum charge of Rs. 350 per month. The applicable fixed charges shall be billed based on 50% of the sanctioned load or Actual MDI for the month whichever is higher. In such case there would be no minimum monthly charges even if no energy is consumed

Yes, these changes are applicable nationally based on GoP’s uniform tariff policy.

This relief was applicable on industrial customers having TOU tariff, falling into any of the following categories i.e., B1, B2 B3 B4 & B5.

Peak subsidy was approved till June 30, 2022. As there has been no further extension in the peak hour relief provided to Industrial electricity customers, accordingly these customers will be charged Peak and Off-Peak rates from July 1, 2022.

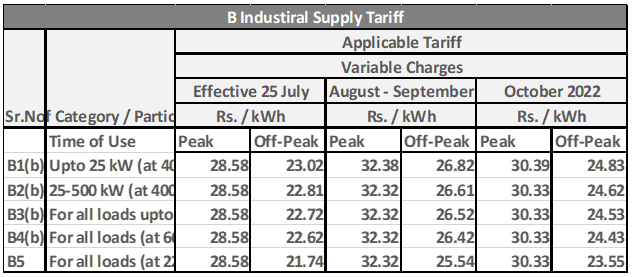

Peak subsidy was approved till June 30, 2022. As there has been no further extension in peak subsidy, Industrial Customers (ToU) will be billed according to the below Time of Use (ToU) Tariff

From 1st – 6th July, SRO 1429 was applicable, the industrial rates of which are same as mentioned in SRO 1004 dated July 7th 2022

From July 7th – 24th July per SRO 1004, applicable Tariff will be

From July 25th onwards per SRO 1175, applicable tariff will be

For B1 consumers there shall be a fixed minimum charge of Rs. 350 per month. The applicable fixed charges shall be billed based on 50% of the sanctioned load or Actual MDI for the month whichever is higher. In such case there would be no minimum monthly charges even if no energy is consumed

Five export sectors namely Textile, Carpet, Leather, Sports and Surgical Goods fall under the Zero Rated category.

In case you feel that the tariff has been erroneously applied on your electricity bill, please immediately visit your closest Customer Care Centre for correction of the bill. Alternatively, you may write to us at tariff.helpdesk@ke.com.pk. We will aim to rectify any mistake within 10 working days.

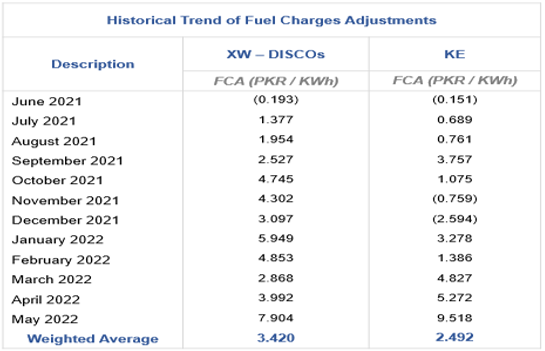

- Positive FCA i.e fuel cost increase are applied across all customer categories; Residential, industrial commercial except lifeline consumers.

- Negative FCA i.e. fuel cost reductions are not applied to lifeline consumers, residential consumers having consumption up to 300 units in that month and agriculture consumers

For example, please refer positive FCA SRO for the month of September 2021 here and negative FCA SRO for the month of December 2021 here

As per NEPRA SRO (e.g May 2022 FCA Decision) and the Government of Pakistan policy which is the same throughout Pakistan:

- Fuel Cost increases are not applicable to lifeline consumers. For definition of lifeline consumers, please refer Question 23 of Tariff Queries

- Fuel Cost reductions are not applied to lifeline consumers, residential consumers having consumption up to 300 units and agriculture consumers

FCA is a monthly adjustment based on the variation actual fuel costs incurred by power utilities and is determined and notified by NEPRA. This will be a regular feature based on any variation in fuel prices/mix as per the approved tariff mechanism. Consumers also get a benefit in form of negative FCA when fuel prices decrease

Negative Fuel Charge Adjustment means that the customer will not be charged for FCA for the month, instead the customer will get a benefit of the approved amount. The amount of benefit is calculated by multiplying approved negative FCA for the month with the units consumed in the month. This is in line with NEPRA’s direction.

- Additional Surcharge (PHL) being applied on bills March onwards. Read more here: http://bit.ly/3JFeFOm

- Application of FCA that was deferred last year. Read more about it here: http://bit.ly/3JkNXZW

- GST increased from 17% to 18%

For further details please read the S.R.O here: http://bit.ly/3JFeFOm

For further details please read the S.R.O here: http://bit.ly/3JFeFOmWhile consumer bills are generated against electricity consumed, loadshed is based on the proportion of losses on a feeder level, which are determined on the basis of theft of electricity and non-payment of bills. This is in line with the Government of Pakistan’s National Power Policy and applicable across the country.

The revised loadshed schedule is being implemented due to various factors including rising demand of electricity and temperatures. However this increase in duration of loadshed is a temporary measure. We will continue to keep consumers updated of the changes through our regular channels.

KE is engaged with all relevant stakeholders for the urgent release of legitimate dues which are critical to continue purchase of fuel. At the same time, KE is making all endeavors to secure cheaper indigenous fuel.

The updated schedule has been uploaded on KE’s website

Customers registered via KE’s 8119 service are being informed of this change through advance SMS. To register yourself for SMS updates, type ‘REG’, followed by a space, followed by your 13-digit account number and send it to 8119

The schedule is available on our website. It can also be accessed via the KE Live App, KE’s WhatsApp Self-Service Portal, Social Media, and Call center 118

If the consumer sells the premises where the connection is installed, it shall be obligatory upon the new owner to apply to KE for a change of name. Such an application shall be accompanied by written consent of the previous owner regarding transfer of the security deposit in the name of the new owner.You can get your name updated on the bill by providing the following documents:

- Sales Deed / Conveyance deed for immovable property / Sub-Lease / Mutation Letter (not for Kachi Abadi)/Registered Gift Deed, Transfer, Allotment Letter/Order In Multi-story project issued by builder or Certified true copy of Form VII/II issued by Mukhtiakar.

- CNIC

- All dues must be cleared

- Undertaking on plain white paper

Additional Documents for Industries/Commercial:

- NTN certificate

Additional Documents for Tenant:

- Tenancy agreement

- Owner CNIC copy

- NOC from Owner

Additional Documents for Kachi Abadi: (any of one)

- letter from Municipal town / Town office

- PT1 certificate Bring all original documents at the time of submission.

- Certified true copy of Sanat – Gothabad Scheme Issued by the Board of revenue.

Bills are prepared and dispatched each month on a specific date. However, in case of non-receipt of your bill, you can do the following:

- Click here to generate a duplicate bill

- Email us at bill@ke.com.pk

- Visit your nearest IBC to get a duplicate bill.

- Call 118

The collection of the TV license fee through electricity bills was introduced by the Government of Pakistan through the Finance Act 2005. Pursuant to this, KE has been a collecting agent for the TV License Fee since May 2008. Exemption certificate issued from PTV can be submitted by the consumers at customer care center of KE for processing of TV licensee fee waiver. Alternatively, the exemption form (available at https://www.ke.com.pk/media-center/downloads/) can also be downloaded and submitted to KE after filling the required information with following documents so that the same will be forwarded to PTV on behalf of consumers for further processing of TV licensee fee waiver: 1. Consumer Application 2. Last paid KE bill copy (of both side) 3. CNIC copy of applicant 4. Affidavit on Rs.50 /- Stamp paper

KE has devised a strategy based on two key drivers:

- Theft (illegal kunda connections)

- Recovery ratios (bill payment by consumers)

Aggregate Technical and Commercial Losses (ATCL) determines how many hours of load-shed will be planned for each zone. KE has divided Karachi into four zones: Currently, 61% of Karachi, including low loss residential areas and industrial zones, is exempted from load-shed (as of Jan 2015). In 2008-2009, only 28% of the city was exempted from load-shed. We can’t continue to provide uninterrupted supply in areas where we don’t get paid for the services we provide.

Most certainly. If consumers in an area support KE in combatting theft and duly pay their bills, then as per KE policy they will be moved to a lower loss zone depending on the losses reduced and hence face a lower duration of load-shed.Analysis of the area Aggregate Technical and Commercial Losses (ATCL) is conducted after every three months, whereby depending upon the losses in the area, the load-shed duration is applied.

K-Electric is deploying Aerial Bundled Cables (ABCs) across Karachi in an effort to combat theft and provide safer and more reliable power across Karachi. These cables are insulated and therefore also prevent the illegal consumption of electricity. KE has also initiated Project Ujala whereby the utility collaborates with communities across Karachi to install ABCs and low-cost meters for those consumers who were previously abstracting power illegally. Community support is proving to be a sustainable way to not only combat theft but also improve the quality of life for the communities and residents concerned. KE has also launched the low-cost meter drive in various areas of Karachi, whereby consumers who are currently not part of our network are encouraged to convert to low-cost meters without risk of any prosecution for power theft or illegal abstraction. KE has launched the Smart Grid project, which allows monitoring of electricity remotely and will have a major impact on controlling electricity theft. The project is currently in its pilot phase in North Karachi; we plan on expanding it across Karachi. KE regularly conducts kunda removal operations in various areas, regular updates of which are made to the consumers via our communication channels (including social media). KE also conducted crackdowns against defaulters and power thieves with the ‘Name and Shame’ campaign in 2011-2012 and Operation Burq in 2015-2016. K-Electric has also set up a dedicated channel Speak Up whereby consumers can report theft anonymously by emailing speakup@ke.com.pk . Community support is vital to reduce theft in an area. While KE has taken various initiatives to control theft, only in areas where the community has joined KE’s efforts has there been a sustainable solution for reducing theft. This in turn benefits the residents of the locality in the form of reduction in load-shed and faults.

https://www.ke.com.pk/load-shed-schedule/ To find the name of your respective feeder, download our KE Live mobile app, or call 118 or inquire through KE Social Media (facebook and twitter). Please note only the list of feeders that will face load shedding are mentioned here.

- Residential Users: Households consuming over 200 units of electricity per month in case of non ToU consumers.

- Time-of-Use (ToU) Consumers: Must have a total monthly consumption (peak and off-peak) greater than the historic benchmark consumption to qualify for the package.

- Businesses and Industries: Commercial and industrial users are eligible.

- General Services: Consumers connected to XW-DISCOs or K-Electric.

The package aims to make affordable electricity accessible across Pakistan.

- Consumers with net metering systems are not eligible except for industrial net metering consumers

- Consumers with faulty meters for the applicable month

- Agriculture, public lighting and bulk supply

- Pay all your KE bills on time for 12 consecutive months.

- Access exclusive discounts from a variety of merchants through the KE Live app.

- Offers under KE Star Rewards cannot be redeemed for cash.

- KE Star Rewards offers are exclusive and can only be redeemed through the KE Live app.

- Share your KE Live referral code with a friend.

- Earn points for each successful referral.

- Start inviting friends now! Find the “Refer a friend” section in the side menu or tap the “Invite a friend” button.

- Promo Codes/Rewards and Leaderboard:

- Only Promo Codes/Rewards Only

- Leaderboard Challenge

Enjoy exclusive rewards and friendly competition! Earn points, unlock discounts, and climb the leaderboard to win amazing prizes.

Unlock amazing discounts with every referral! Earn points and redeem them for exclusive promo codes.

Compete to be a top referrer! Climb the leaderboard and win exciting prizes. Limited time only.

- This campaign is open to KE Live App users only.

- No entry fee nor any financial contribution is required to participate in this campaign.

- To participate you must share your unique referral code via email, SMS, WhatsApp, or other messaging platforms.

- You can find your unique referral code in the “Invite Friends” tab from the side menu on the app.

- You will earn points for each successful referral when a new user signs up using your referral code.

- For every point earned, you will receive a promo code.

- Each campaign has a specified start and end time.

- Rewards for referrals can only be won within the prescribed campaign period.

- The winner may be notified via a call or email and shall be contacted only by the phone number or email provided. If the winner cannot be contacted, KE reserves the right to withdraw the prize from the winner and pick another winner.

- The prizes are as stated, and no cash or other alternatives will be offered. The prize is non-transferable and non-exchangeable and are further subject to availability. KE reserves the right to substitute any prize with another of equivalent value without notification.

- The winner agrees to the use of his/her name and picture for publicity. Any personal data relating to the winner or any other participants will be used by KE in compliance with applicable laws of Pakistan.

- Points can be gained even if there is no campaign active.

- Users reaching a specific points threshold qualify for the leaderboard.

- The top users on the leaderboard at the end of the campaign will win exciting prizes.

- Points and promo codes are non-transferable and cannot be exchanged for cash.

- KE reserves the right to disqualify any user suspected of fraudulent activity or violating the terms and conditions.

- KE reserves the right to modify or terminate the campaign at any time without prior notice.

- KE is not responsible for any technical issues or delays that may affect participation in the campaign.

- By participating in the campaign, you agree to the collection and use of your personal information as described in the app’s Privacy Policy.

- By participating in the “Refer a Friend” program, you agree to these terms and conditions.

All KE consumers who pay their electricity bills using eligible UBL credit cards through the UBL digital app are entitled to the cashback.

| BIN | Category | Card Type | Discount Cap in PKR |

| 472439 | Platinum | VISA Credit Card | 2000 |

| 410525 | Gold Card | VISA Credit Card | 1000 |

| 418232 | Auto Gold Card | VISA Credit Card | 1000 |

| 410524 | Classic Card | VISA Credit Card | 1000 |

| 418231 | Auto Classic Card | VISA Credit Card | 1000 |

A solar PV (Photovoltaic) system absorbs the sun’s irradiation and converts it into electricity. Solar panels are made of highly conductive materials. When the sun rays hit the solar panels, it generates DC (direct current) power. The DC energy passes through an inverter to become the AC (alternating current) power which becomes electricity that lights up the connected load.

There are three different types of solar PV systems.

- Grid connected solar PV system: the on grid solar system is tied to your local utility’s grid. This is the most common system that is used in residential settings. The residence will be covered if there is requirement for more energy than that produced by the solar PV system as it will be able to take it from the grid. In case of surplus energy, the excess energy can be sold to the grid as per the National Electric Power Regulatory Authority (Alternative & Renewable Energy) Distributed Generation and Net Metering Regulations, 2015.. An on-grid system will use the energy produced from the solar panels during the day and will switch to the grid electricity during the night.

- Off – grid solar system: An off grid solar system means that you are not connected in any way to the grid. To achieve this however, there is a need to purchase back up battery systems, which can be expensive, bulky and are not very environment friendly. The battery systems will be charged during the day from the energy produced by the panels and will be used during nighttime.

- Hybrid solar system: A hybrid solar system refers to a combination of solar and energy storage while also being connected to the grid.

| Solar modules | 10 Years (Replacement)/ 25 Years (Performance) |

| Solar Invertor | 10 Years (Replacement) |

| Solar Structure | 10 Years (Maintenance) |

| Workmanship(Miscellaneous plant equipment) | 2 years |

The solar energy generation will depend on the size of your system, solar irradiance in your location and various environmental variables that influence the efficiency of solar PV system. Please refer to K-Solar calculator for specific details. For a thumb rule: 10kW On grid system will produce around 1500Units on monthly basis

Space requirements will differ from roof to roof depending on obstructions and shading due to adjacent buildings or trees etc. The definitive space requirement can only be provided after a physical survey of roof. To keep roof area usable, elevated/semi-elevated solar mounting structure could be chosen, which costs 10-15% more than standard roof mount structure.

Residential Customers:

| S.No | Gross amount of billed | Active Tax Payer | Inactive Tax Payer |

|---|---|---|---|

| 1 | if the amount of monthly bill is less than Rs 25,000/ | 0% | 0% |

| 2 | if the amount of monthly bill is Rs,25,000/- or more | 0% | 7.5% |

Industrial & Commercial Customers:

| S.No | Gross amount of billed | Tax rate |

|---|---|---|

| 1 | Upto Rs. 500 | Rs. 0 |

| 2 | exceeds Rs. 500 but does not exceed Rs. 20,000 | 10% of the amount (between 500 and 20,000) |

| 3 | exceeds Rs.20,000 | Rs. 1,950 plus 12% of the amount exceeding Rs. 20,000 for commercial consumers Rs. 1,950 plus 5% of the amount exceeding Rs. 20,000 for industrial consumers |

- Update your scanned CNIC copy HERE

- Visit a KE Customer Care Centre with a copy of your valid CNIC and your KE Account Number.

- The KE Live App https://www.ke.com.pk/live-playstore (Google Play)

https://apps.apple.com/pk/app/ke-live/id1458106362 (App Store) - KE Live Web Portal https://live.ke.com.pk/Pages/LoginPage.aspx

The Change of Name process may take up to nineteen (19) working days. You will receive a confirmation of completion via SMS. We will update your user account details on receipt of your complete request.

OR Saving 0348-0000118 to your contact list and WhatsApping us a “Hi”

OR Saving 0348-0000118 to your contact list and WhatsApping us a “Hi”- Get your Duplicate Bill and get information regarding bill payment options.

- Learn about your current Power Status and raise a complaint if needed.

- Lodge a billing complaint without visiting the Customer Care Centre

- View your load-shed schedule.

- Get your Income Tax certificate.

- Get guided about applying for a New connection.

- Convenience of receiving your bill whenever and wherever you are

- Ease of making your digital payments through e-links to digital platforms

- Never losing your bill in the mail

- Receiving your bill on time, every time

- Never again worrying about filing and storing paper bills

- Contributing to environmental sustainability by conserving trees and water, and cutting CO2 emissions and landfill waste.

When you subscribe to ebilling, you agree to switch your medium of bill receipt from physical paper to electronic delivery via email. If ebilling does not work out for you, you can easily revert to paper billing by sending an email on customer.care@ke.com.pk

Any time you want, you can easily download copies of your ebills through the KE website https://www.ke.com.pk/customer-services/e-billing/ , WhatsApp https://wa.me/923480000118/?text=Hi , KE Live App https://onelink.to/kelive or through our SMS service. Please do keep your KE account number handy when using these services. Your 6 months billing record is maintained at all these platforms. Should you require an older statement, please visit your nearest IBC or call us at 118.

You can register multiple email addresses against your KE account. Email us at customer.care@ke.com.pk, the other email IDs you would like to register for ebilling with subject “REGISTER ADDITIONAL E-BILLING ID”. The registration process may take up to 02 days. ebills will be dispatched to additional registered email IDs from the next billing cycles.

If you have multiple email addresses registered against your Account, your monthly bill will be sent to all registered email addresses.

If you are a subscriber to ebilling, you can still maintain a separate record of your KE bills by either printing out the ones that you need physically or saving bill copies to other storage devices i.e. hard drives.

Your monthly KE E-bills will be saved in your email inbox for years and can easily be extracted by entering KE’s email ID (noreply@billingke.com.pk ) in the email search bar. Download and save these bills to any external devices. 6 months billing record can also easily be downloaded from the history via KE Live App https://onelink.to/kelive, KE WhatsApp https://wa.me/923480000118/?text=Hi , and KE Website https://www.ke.com.pk/customer-services/e-billing/ whenever you want. Should you require an older statement, please visit your nearest IBC or call us at 118.

Pay online by entering your KE Account Number only. Your most-recent billing amount due will be auto-updated in the banking system. If you want to pay using digital wallets like Easy Paisa, Jazz Cash, or Upaisa, you can do so through their digital apps, which allow you to make digital payments without the need for a physical copy of the bill. However, if you prefer to make payments in person, you may need to bring a paper bill with you when you visit a physical shop. Pay your KE bill physically at Bank branches, Postal Offices, and shops via (Easy Paisa or Jazz Cash) by printing the ebill and visiting the physical channel with the printed bill and the payment amount.

Pay online by entering your KE Account Number only. Your most-recent billing amount due will be auto-updated in the banking system. If you want to pay using digital wallets like Easy Paisa, Jazz Cash, or Upaisa, you can do so through their digital apps, which allow you to make digital payments without the need for a physical copy of the bill. However, if you prefer to make payments in person, you may need to bring a paper bill with you when you visit a physical shop. Pay your KE bill physically at Bank branches, Postal Offices, and shops via (Easy Paisa or Jazz Cash) by printing the ebill and visiting the physical channel with the printed bill and the payment amount.Don’t worry if you happen to miss KE’s ebill email. We will supplement the email with SMS and call reminders to ensure that you stay on top of your bill payments. If for some reason you are unable to find your ebill email or if it has been deleted, you can easily download copies of your ebills via KE Live App https://onelink.to/kelive, KE WhatsApp https://wa.me/923480000118/?text=Hi , and KE Website https://www.ke.com.pk/customer-services/e-billing/ and our SMS service. Please do keep your KE account number handy when using these services.

You can subscribe to ebilling regardless of your payment platform. As long as you pay the bill through their mobile app, physical copy of the bill is not required. If you opt to pay in-person at a mobile shop, you must carry a printed copy of the bill as well.

You can unsubscribe from ebilling at any time by writing to us at customer.care@ke.com.pk. We hope you will consider re-subscribing to ebilling when it is more convenient for you.

You can always get your registered email address or contract account changed by simply writing it to us at customer.care@ke.com.pk.

Ebills can be downloaded and printed when required and all physical channels like Bank Branches/Postal Office will accept these copies. However, we strongly urge that you shift to any of these convenient digital payment platforms https://www.ke.com.pk/customer-services/e-billing/ where you can pay your bill with just a few clicks from the comfort of your home and save both time and commute costs.

KE has recently introduced a digital “Paid” stamp on KE bills that confirms that your electricity bill has been paid and allows customers to keep track of their payments, eliminating the need for physical bills or payment receipts for record-keeping and accounting. It also makes it easier for customers to transition to the convenience of e-billing.

The “Paid” stamp on KE’s digital bills confirms that your electricity bill has been paid allowing you to:

- Keep track of your payments

- Eliminating the need for physical bills or payment receipts for record-keeping and accounting

- Conveniently shift to e-billing (https://www.ke.com.pk/customer-services/e-billing/)

- Never worry about filing

- Cut down your paper footprint and help save trees and water

Q22. For how many months can I view the digital stamp on my paid KE bills after they have been paid?

You can access your historic KE bills for up to 6 months from the KE Live App, KE WhatsApp and KE website. Any paid bills during this period will carry the relevant payment stamp.

Once the payment is reflected on KE System, you will be able to view digital stamp against your KE bill through any digital channel from next day.

Stamp will be reflected against the month for which the bill has been paid regardless of whether the amount is paid within due date or after due date.

Whether bill payments are on installments/schemes/advances/tokens, the relevant digital stamp will still be reflected against your KE bill subject to payment being received by KE.

Q3. Can elderly or differently abled persons avail bill installment or token bill from 118 helpline?

Q6. Can all commercial, residential and industrial customers avail these services from 118 helpline?

- Cardholder must have sufficient limit of funds the issued Credit/Debit card.

- On the duplicate bill page select “Payment Method”.

- Enter complete cardholder details. Full Name, Email, Mobile Number, Card number, CVV, Card Expiry Date, input OTP received on the registered mobile number or email.

- Verify & Pay Verify payment details thoroughly. Click “Confirm and Pay” to complete the transaction.

This subsidy is applicable on industrial consumers having TOU tariff, falling into any of the following categories i.e., B1, B2 B3 B4 & B5.

Peak Rates are revised and are same as Off Peak, effective November 01, 2020 to April 30, 2021, further extended till June 2022.

The benefit of the subsidy was reflected starting from the December 2020 billing period of industrial consumers.

There are two ways to register for the SMS service:

- Register online; simply click here and submit your 13 digit A/C # and mobile number.

- Register via SMS; type REG(space)[your 13 digit A/C #] and send this SMS to 8119.

Shortly after submitting your request, you will receive a welcome note that confirms your registration with the K-Electric mobile service.

Annual preventive maintenance shutdowns are periodically carried out in various parts of Karachi constantly to make sure the system is working smoothly. Customers of respective areas are given prior intimation via SMS. The power utility also continuously conducts system upgrades across the network such as the replacement of traditional cables with theft and kunda resistant Aerial Bundled Cable (ABC). These shutdowns and preventive maintenances are essential to ensure the system continues to operate at an optimum level.

- A 5% surcharge will be applied on the amount billed excluding taxes and duties if full payment is made within 3 days after the due date

- A 10% surcharge will be applied on the amount billed excluding taxes and duties if full payment is made 4 days or more after the due date

- If a customer pays within 3 days after the due date, they will be charged a Late Payment Surcharge (LPS) of 5% on the amount billed excluding taxes and duties.

- If a customer pays after 3 days of the due date, they will be charged a Late Payment Surcharge (LPS) of 10% on the amount billed excluding taxes and duties.

For example, if the current electricity charges are Rs. 10,000:

- Paying within 3 days after the due date would result in an LPS of Rs. 500

- Paying after 3 days would result in an LPS of Rs. 1,000

- Use online payment methods from the comfort of your home

- Keep track of bill due dates using the KE Live app

- Subscribe to e-bills to receive email updates for upcoming payments

Bills in addition to the monthly (regular) bill are called supplementary bills. These are charged to consumers for the following reasons:

- Units billed on account for consuming electricity through illegal means

- For any prior period, adjustments in accordance with the criteria specified in CSM for eg. Meter slowness etc.

- For the transition period when the tariff is changed from one category to another

During a random survey, if any activity is found at the premises pertaining to a commercial nature by meter readers/MIO (Meter Inspection Officers), it will lead to a change in tariff from residential to commercial. Please note that as per Chapter 07 of the NEPRA Consumer Service Manual read together with the Tariff Terms and Conditions, the consumer shall, in no case use the connection for the purpose other than for which it was originally sanctioned. In case of violation, the consumer is liable for disconnection and legal action. The phrase for the purpose other than for which the connection was originally sanctioned means if a connection was originally sanctioned under one tariff category for example domestic tariff (A-I) and is being used for commercial purpose i.e. A-2, KE shall serve seven days clear notice to the consumer who is found misusing his/her sanctioned tariff. However, KE shall immediately change the tariff and shall determine the difference of charges of the previous period of misuse to be recovered from consumer. However, in the absence of any documentary proof, the maximum period of such charges shall not be more than two billing cycles. Please note that as per the Tariff Terms and Conditions, Residential Tariff (A1-R) is applicable for residences and places of worship whereas Commercial Tariff (A1-R) is applicable for supply to commercial offices and commercial establishments such as Shops, Hotel and restaurant, Petrol pumps and Service Stations, CNG filling stations, Private Hospitals/Clinic/Dispensaries, Places of Entertainment, Cinema Theater, Clubs, Guest Houses/Rest Houses, Office of Lawyers, Solicitors, Law Associates and Consultants , All private offices

Tariff Changes – May 22, 2019

*To be duly adjusted in case of day light saving

B) Bank Charges and Meter Rent: Bank charges and meter rent are no longer be charged to customers.

C) A3 Tariff: A new A-3 General Services Tariff category was introduced. To find out which categories of customers this Tariff shall be applicable please refer Question 16

D) Lifeline Consumer: The criteria for ‘Lifeline Consumers’ was changed. However, it has been further updated through SRO 1429(1)/2021 dated November 5, 2021. Please refer Question 15 for latest definition of lifeline consumers.

E) B1 & B2 Tariff: The criteria for B1 Tariff was revised to include all Industrial consumers having sanctioned load of up to 25 kW. Whereas B2 Tariff will now be applicable on Industrial Consumers having sanctioned load between 25 kW to 500 kW.

- Test report issued by the Electric Inspector or his authorized wiring contractor

- Copy of last paid bill subject to the condition that no arrears/deferred amount/installments are pending.

- Attested copy of CNIC

- Signed Power Supply Contract can be obtained from KE offices

- Payment of Capital Cost (if applicable)

- Updating of Security Deposit in case of extension/reduction of load at prevailing rates subject to adjustment of already paid security deposit.

Please also note that in case of reduction of load, the Security Deposit shall be updated at prevailing rates and the difference of the Security Deposit shall be refunded/charged, as the case may be.

- Approved religious and charitable institutions

- Government and Semi-Government offices and Institutions

- Government Hospitals and Dispensaries

- Educational Institutions

- Water Supply scheme including water pumps and tube wells operating on three phase 400 volts other than those meant for irrigation or reclamation of Agriculture land

- Embassies and Consulate Generals

Tariff Changes – November 5, 2019

- Default

- Illegal utilisation of excess load

- Theft

- Using the electric connection for a purpose other than for which it was sanctioned

There are different scenarios under which the consumer can be charged estimated billing, including:

- Consumption of electricity while the line is disconnected

- Faulty meter

- Theft of electricity

- This offer is applicable upon new KE Live App download and new customer of Foodpanda.

- Minimum order value – PKR 150.

- Applicable across Foodpanda except Pandamart.

- Voucher validity – 3 months.

- These vouchers will be sent to customers by KE through SMS and or Email.

- In case of queries related to FoodPanda, kindly reach out to their help center on the app

Befiler All new customers who download the KE Live App can avail 87% off on NTN registration and Tax filing. The customers will only need to pay PKR 500/- to avail Befiler services.

Terms & Conditions

- Upon KE Live App download, vouchers will be sent to customers by KE through SMS and or Email.

- Multiple individuals can register, and avail offer against one account number.

- In case of queries related to Befiler please contact 021-38892069